Introduction: Why People Are Rethinking Life Coverage

In today’s uncertain economy, families are increasingly turning to financial tools that offer security without high costs. Among these, term life insurance has emerged as a smart, practical option. Unlike traditional whole life insurance, term policies offer straightforward protection at affordable rates making them especially appealing for young families and budget-conscious individuals.

What Is Term Life Insurance?

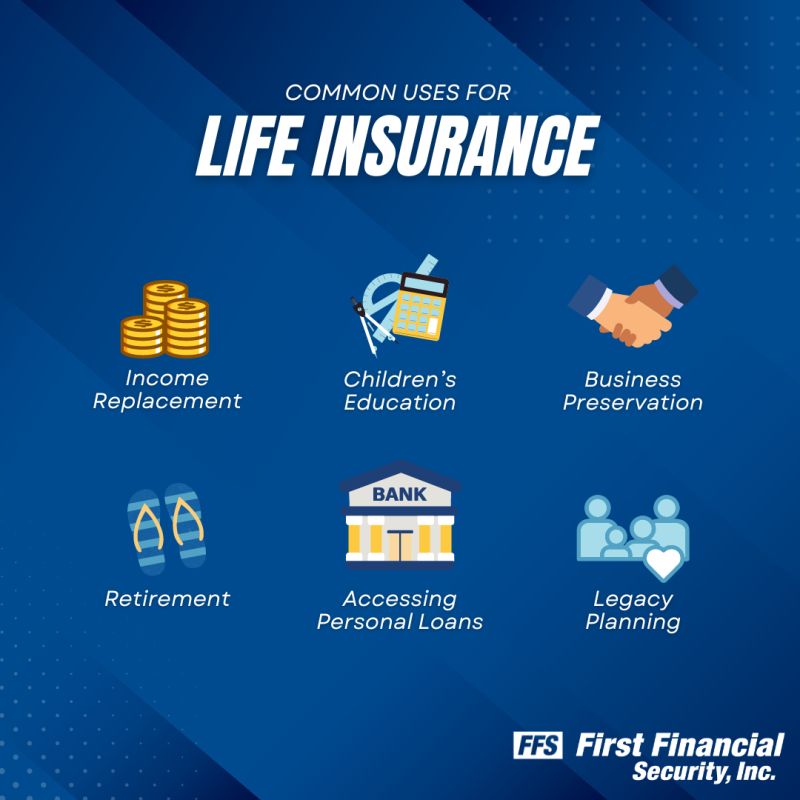

Term life insurance is a type of life coverage that provides a death benefit to beneficiaries if the policyholder dies within a specified time period, such as 10, 20, or 30 years. If the policyholder survives the term, the policy simply expires there’s no payout, but that’s part of why it’s so affordable. It’s a great way to protect loved ones during critical financial years, such as when raising children, paying off a mortgage, or planning for college expenses.

Why It’s the Smartest Financial Move

Here’s what makes term coverage a winning financial choice in 2025:

- Low Premiums, High Coverage: Term life plans offer a much higher payout for a lower monthly cost compared to whole life policies.

- Simplicity: There are no complex investment components it’s pure insurance. You know exactly what you’re getting.

- Flexible Terms: Choose coverage lengths that match your needs such as until your children become adults or your house is paid off.

- Tax-Free Payouts: In most cases, death benefits from life insurance are tax-free, which provides meaningful support to your family when they need it most.

When Is the Right Time to Buy?

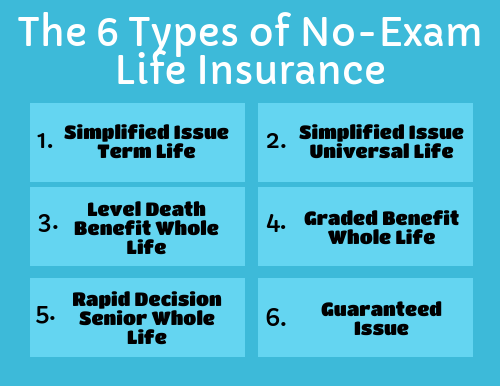

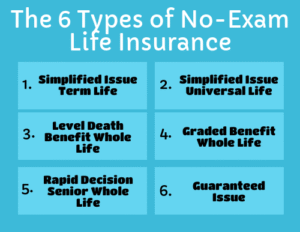

The best time to buy term life insurance is when you are young and healthy. The younger you are, the lower your premium. Even if you’re in your 30s or 40s, it’s not too late many companies now offer streamlined online applications with no medical exams for lower amounts of coverage.

- ✅ In your 20s? Lock in ultra-low premiums.

- ✅ In your 30s–40s? Protect your growing family and financial assets.

- ✅ Over 50? Some insurers still offer 10- or 15-year terms with competitive rates.

Who Should Consider It?

Term life insurance is ideal for:

- Parents with young children

- Individuals with mortgages or other debts

- Anyone who wants affordable, temporary financial protection for their loved ones

- Business partners who want to secure financial continuity

Even if you’re not the sole breadwinner, your contribution to your household matters and replacing that value matters too.

Common Myths About Term Life Insurance

- ❌ “I’m young and healthy. I don’t need it.”

Accidents and illness can happen anytime. Buying now saves money in the long run. - ❌ “It’s too expensive.”

Many people overestimate costs. A healthy 30-year-old can often get $500,000 in coverage for under $25/month. - ❌ “It’s complicated.”

With online platforms and simple calculators, getting insured is easier than ever.

Final Thoughts

In a world where financial security is increasingly fragile, term life insurance stands out as a solid, affordable way to protect the ones you love. It’s simple, reliable, and smart exactly what you want from any financial decision. Whether you’re starting a family, buying a house, or simply planning ahead, this form of coverage can provide peace of mind at a price that won’t break your budget.