If you’re thinking about getting life insurance but dread the medical exams, blood tests, and paperwork, you’re not alone. Many people are turning to no exam life insurance as a fast, simple alternative to traditional policies. But is it really the best option for you? In this article, we break down the pros and cons to help you decide.

What Is No Exam Life Insurance, and Who Is It For?

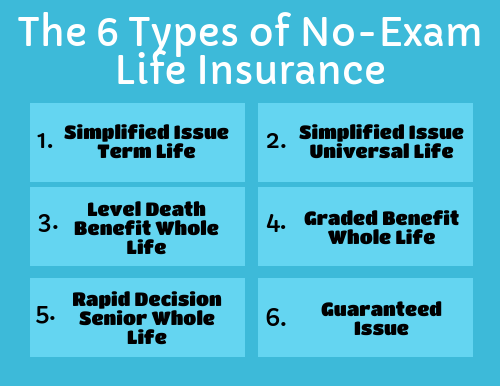

As the name suggests, no exam life insurance is a policy that doesn’t require a medical exam. That means no need to visit a doctor, no lab work, and no long health questionnaires. Instead, insurers use basic information like your age, lifestyle, and medical history (from public databases or prescriptions) to determine your coverage eligibility.

This type of insurance is especially popular among:

- People with pre-existing conditions who fear rejection from traditional insurers.

- Seniors who want quick approval without the hassle of medical tests.

- Young, busy professionals looking for fast and easy coverage.

- Anyone who just doesn’t want to deal with medical appointments or needles.

While it may sound like a perfect solution, there are some trade-offs you should know about before you sign up.

Pros of No Exam Life Insurance

- Fast Approval

Most applications are approved within 24–72 hours. Some companies even offer instant coverage. - Simple Application Process

No doctor visits or lab tests. Just fill out an online form and answer a few basic questions. - Great for Urgent Needs

If you need life insurance quickly—maybe for a loan, travel, or legal requirement—this is ideal. - Reduced Anxiety

People who fear medical tests or don’t want to discuss their health issues benefit from this stress-free process.

Cons to Consider Before Buying

- Higher Premiums

Since the insurer is taking on more risk without knowing your full health background, you may pay more. - Lower Coverage Limits

Most no-exam policies offer lower payout amounts compared to fully underwritten plans. - Limited Policy Options

You might have fewer customization options when it comes to term length and add-ons. - Not for Everyone

If you’re young and healthy, you may actually save money by going through the medical exam process.

Tips for Choosing the Right Policy

If you’re leaning toward this type of insurance, keep the following in mind:

- Compare at least 3–4 different providers.

- Look for policies with fixed premiums, so your cost doesn’t increase over time.

- Make sure the company is well-rated and licensed in your state.

- Read the fine print—some policies have strict clauses or waiting periods.

Final Thoughts

No exam life insurance is a fantastic option for people who want simple, fast, and hassle-free protection. While it may cost a bit more than traditional plans, the convenience and accessibility it offers make it a popular choice in 2025. Just be sure to weigh the benefits against your specific needs and long-term goals.